Don’t we all aspire good health? What is the secret of good health? Is good

health achieved effortlessly? Health is the ability to adapt and self-manage while facing physical, mental or social challenges. Health can be both, physical or financial.

All of us are not born with perfect body or perfect health, and good health is

all about making your body fit. It requires discipline; the discipline of exercise, and the discipline of diet. Once you’ve got the discipline, you need to have patience to see the results. Being financially healthy is like having that healthy body. To get there we need to develop the discipline of income and expense management, and systematic investment planning. Patience, of course, is the key.

For all of us who ever have enrolled for any fitness class, the first lesson we

learn is – no pain, no gain. When any muscle is exercised it initially leads to pain. With sustained practice we become immune to the pain and begin to realize the benefits of exercise. The same holds true about diet. When we switch to healthy eating habits, the craving for unhealthy food initially increases. But once the good habits and their benefits set in, the cravings diminish and healthy eating becomes a way of life.

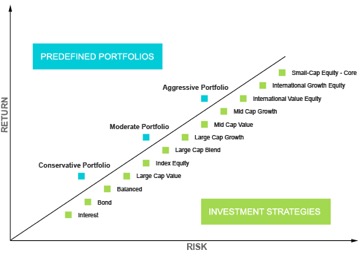

The concept of risk and return in finance is similar to the principle of pain

and gain in exercise. If we want more fitness we need to exercise more. Similarly, if we want more return we should be willing to take more risk. Ask anybody who does fitness training what kind of pains they go through to get that body. Just like sustained practice is required to reduce the pain and gain from the benefits of exercise, risk appetite is also a habit that can be developed over a period of time to gain better returns from investments.

While pain is good for the exercising body, an excess of it can actually be

injurious. The same applies to risk. It is important that we understand what level of pain is optimal for ourselves. Each one of us has a different threshold for pain and risk and this should be taken into account when planning an exercise regime or an investment plan. Though it is never too late to start, it is usually a better idea to start early in life with both exercise and financial planning. It is an investment in our health- physical and financial.

When we are young, our body has a greater capacity to bounce back from

rigorous exercise with much lesser pain. As we get older, the body needs more time to recover from pain related to exercise. Our ability to take risk is also similar. When we are young, we have lesser responsibilities and higher capacity to take risk. Our limited knowledge about financial products and the risks and returns associated with them causes us to have a lower risk appetite. As we grow older we often understand the risks involved in investments and have a larger appetite for risk but do not have the capacity to take the risks since the demands placed on the

finances are more.

Different financial products have different risk and return tradeoff. A good

Financial Plan brings about great financial health by tailoring our financial plan based on our risk and return profile, in the same way that a good personal trainer, brings us greater fitness benefits by tailoring the exercise and diet regime to suit our individual requirement. No pain, no gain and with the right balance of pain and gain you can be healthy, wealthy and wise.

- Higher risk products usually promise higher returns

- Risk appetite is different from risk capacity

- Risk profile changes with time

- Different financial products have different risk and return matrix

- Our investment plan should be suitable for our risk profile

Recent Comments